Solution page 4:

Producer Credits

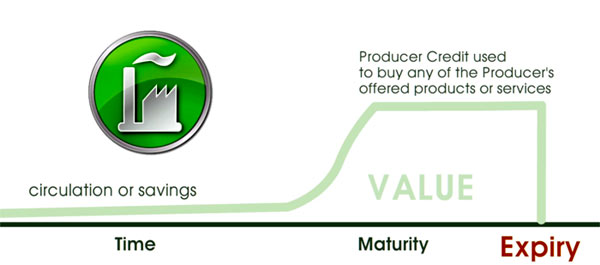

In this proposed system, Producer Credits are time-limited contracts for delivery of something specific from someone specific called the Issuer. For example, Toyota credits would be spent by Toyota to build Toyota products. Toyota's employees and suppliers would be paid in Toyota Credits and spend them as money into general circulation. Acceptance of Toyota Credits would be very nearly universal so they could flow as money around the globe.

Between the time that Toyota spends its Producer Credits on wages, plant and supplies, and the time the customers redeem them for Toyota products, (which might be a full year), these credits can be used as defined-value redeemable money by third parties not related to either Toyota or the final customer.

Toyota would offer a discount on its products if they are bought with Toyota credits. Like interest, this discount would build over time from issuance, peaking at the maturity date which Toyota would set to match the time it wants to sell the products. Toyota's customers would seek to obtain as much "money" in mature Toyota Credits as possible in order to get the best price.

After maturity comes a grace period when Toyota Credits would still be redeemed by Toyota but could no longer be traded as money within the system. Unredeemed credits would expire after the grace period.

The value of a Producer Credit is defined by the Issuer's promised redemption in real goods and services and thus by the prices the Issuer sets. A Producer Credit must be also be backed by conversion to a shareholder claim on the Issuer's equity in liquidation should the Issuer fail.

In this way, "money" is created by a promise of production

and extinguished by redemption in that production.

The chapters on Self-Issued Credit from Money as Debt III

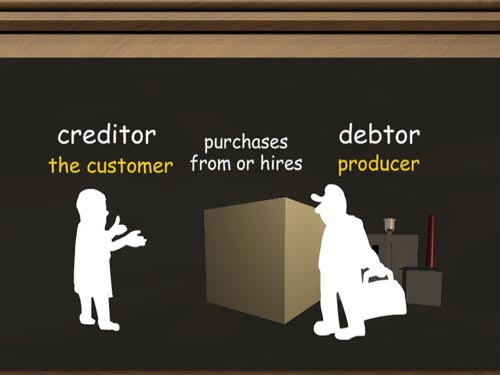

A Producer Credit is a form of stock in the Issuer, in which the Issuer guarantees to buy back the stock with product or service. A dividend may be offered by the Issuer so that the redemption value rises to a fixed maximum at maturity. This dividend payment is promised in the form of additional product or service ONLY, which in practice will mean a lower price for the redeemer. Simply put, the Issuer honors its own Credits at a higher value (of its own choosing) than any other Issuer’s Credits.

From the customer's point of view, acquiring the Issuer's credits earns a discount from the "regular price". From the issuer's point of view the "discount price" is the regular price. Ideally, all of the Issuer's production will be bought with all of the Issuer's own Credits that were spent to produce it.

This is adapted from the principle governing consumer-producer cooperation in existence today. The essence of the idea is that, if a customer gives a farmer money for carrots in April, that customer gets more carrots than someone who just shows up to pay for the farmer’s carrots in September. This is deserved because the April customer has made a commitment and taken a risk on that particular farmer, as the price and quality of the carrots is not guaranteed, only the “share of the harvest”. Thus the April customer is an investor not a lender and the benefit derived is a dividend, no matter how it is calculated.

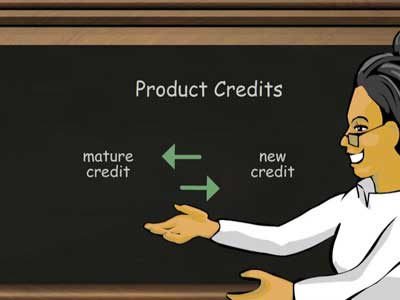

An Issuer's employees and suppliers are the first to give value in exchange for the Issuer's Producer Credits. Then the Credits are spent at retailers and paid to other suppliers and employees. Some are put aside as savings and exchanged for newer Credits when they approach maturity.

The chapter on Savings from Money as Debt III

Ultimately the customer that redeems the product gets the discount, not the employee that first accepted it. That makes it different than a particular person financing a particular farmer. However, to the extent that the "imaginary" discount at every level of Credit redemption is realized in lower retail price levels, everyone would realize the "discount" whenever they purchase anything.

This concept of "money" makes it possible to monetize ALL goods and services in reliable demand. This seems to be, simultaneously, the most rational and most idealistic way to back a trading medium. Instead of backing currency with artificially valued gold, or with nebulous concepts of limited resource bases, this system very rationally backs the trading medium with the current and near future production of goods and services that produce the need for the trading medium. In addition, from an idealistic standpoint, the trading medium itself directly embodies the people’s faith in and support of each other.

It should be noted that Producer Credits are also "money as debt", but instead of being a debt of money itself,

Producer Credits are a debt of promised goods and/or services only, which means that:

1. the Issuer makes a sale and extinguishes its Producer Credits or;

2. the Issuer may replace expiring Producer Credits with new ones (roll over debt) or;

3. the Producer Credits expire, an immediate loss, leaving no legacy of debt.

A Producer Credit is a contract for products and/or services and may be recorded either as an accounting entry or, in the future, encoded as a transferable digital object like a Bitcoin. But, rather than being a speculative commodity, this digital object would be a promise of a specific measure of goods or services.

In either form, it is a contract backed by a promise of future productivity, as in conventional bank credit. But rather than "money" being created as the money-debt-at-interest of individual consumers, Producer Credits are "money" as a claim on the near term production (and in liquidation, the assets), of a producing industry. It is the author's opinion that short-term (up to annual) production is a more stable and realistic source of money creation than 30-year mortgages that are predominantly the debt of individuals.

The Issuer would also guarantee redemption in product at par with the value unit. This creates a "floor" of guaranteed value. It is also possible to protect the value of Producer Credits from monetary inflation/deflation by being denominated in an inflation-proofed value unit.

Sorting Producer Credits would be like sorting emails that have a numerical value in a common unit: short movie