Solution page 10:

Diversity in Money Creation

The solution to the problem is to expand the concept of money to include

"promises of something specific from someone specific."

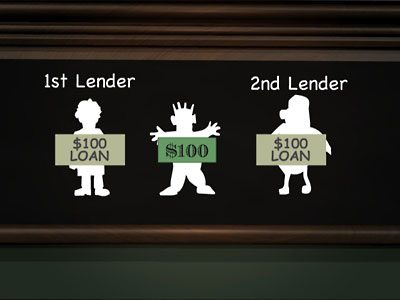

In the analysis of the problem, I proposed that money, even in the form of gold coins or Bitcoin will eventually concentrate in the ownership of the economically more powerful and become twice-lent. In the current system, where money is created as a debt-of-itself, money is twice-lent by its very nature.

The Standard Theory seems to be that most savings are used for investment. But investment in what? Productive industry that pays wages to people who may have mortgages? Or a money market mutual fund where the money is lent? There's a big difference. Money invested in productive activity is returned to circulation free of any second debt. It can then be earned by the borrowers who originally created it and paid back to the bank. The debt can be extinguished without creating a new debt. In contrast, money markets, including bank deposits, put a second debt on the same Principal.

Therefore, the proposed solution is that savings be held as redeemable inflation-proofed Producer Credits instead of bank credit. This way, savings are always used to fund short term production.

Savings would be redeemable in real goods and/or services, and retain their purchasing power.

Isn't that what savings ought to be?

The exchange of conventional money for inflation-proofed Producer Credits would fund Issuers in the conventional money system, while removing the exchange rate and inflation risks for the saver. Most importantly it would return bank credit money to circulation debt-free, relieving the mathematical problem that creates the grow-or-collapse-in defaults imperative in the current scarcity system.

Producer Credits are an expansion of what money means that allows the liberation of money

while simultaneously providing the remedy for the current system's inherent mathematical flaws. Thus the proposed system is put forth as an expansion of banking because there is no need to do away with banking.

This could be a cooperative transition.

To illustrate, please consider this spectrum of payment methods.

back / next ~ Payment Spectrum