Solution page 14:

What is the Value Proposition for a Bank

to expand into Producer Credits?

I believe that there is a compelling case for conventional banking to expand into the Producer Credit system for its own benefit as well as that of everyone else. This page will explain why, in detail.

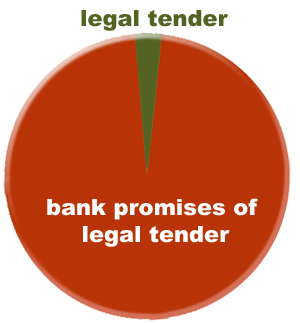

Banks create deposits as promises of legal tender on demand.

Banks only have about 3% of the legal tender they promise.

A deposit is not an asset to a bank.

It is a liability, a promise to pay legal tender on demand.

Nonetheless, banks MUST attract deposits

in order to be able to make loans.

This is the explanation.

1. A checking account deposit means the demand for legal tender the bank doesn't have has been indefinitely deferred. A term savings deposit means that the depositor very probably won't be asking for that legal tender or transferring that deposit to another bank for the definite term of the deposit. The safest "deferred demand" for legal tender is a long term savings deposit and banks pay interest for that certainty.

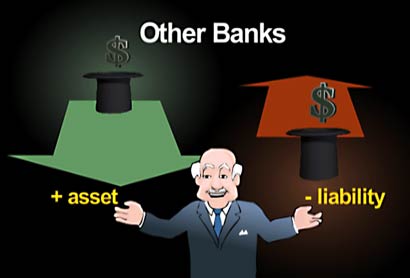

2. An incoming deposit from another bank balances out against a deposit outgoing to another bank. The banks just trade liabilities to their depositors and the net result is the banks don't owe each other anything.

To succeed at creating money as promises of legal tender that the banks don't have requires that banks receive an equal amount of these promises back as deposits. Therefore, a banks' ability to create money as loans without being in debt to other banks, is dependent on the deposits it receives.

This Chapter from Money as Debt II illustrates how this works.

To attract long term savings deposits, banks must offer competitive rates of interest. These rates of interest are currently far below the rate of inflation. Therefore...

Savers steadily lose purchasing power.

In real purchasing power,10% annual inflation means half of our savings evaporate every 7.3 years.

Banks could, instead of term deposits at interest,

offer redeemable inflation-proofed Producer Credits to savers.

![]()

The savers would pay for Producer Credits with bank credit or legal tender.

The banks would receive fees for services involved with creating, selling and exchanging Producer Credits.

The results would be:

1.The money received by the Producer would be SPENT into circulation immediately to fund production instead of locked up in savings or lent a second time.

2. The Producer would receive current value for the conventional money.

3. The money spent would be deposited in a transaction account on which the bank pays no interest.

4. The money deposited in the transaction account still serves the two essential purposes listed above.

In the new expanded system, the banks would attract transaction deposits in Producer accounts with offers of inflation-proofed Producer Credits to be sold for bank credit to savers. The savers would get the "dividend" the Producer offers in real goods or services, instead of the bank piling on exponentially compounding interest in promises of legal tender it doesn't have. The banks would get a proportionate increase in Producer transaction accounts that would still serve to net out their liabilities to each other

This is advantageous to all concerned in seven distinct ways

1. Society, the Economy and the current Banking System

Savings themselves AND the interest paid on savings in the current system are both "twice-lent money".

According to the analysis presented, twice-lent money is what creates the grow-or-collapse mathematical trap that plagues the world. Eliminating savings as bank credit would solve the core instability problem of our current money system by returning bank credit money to circulation where it could be earned rather than having to be borrowed a second time to pay off the debt that created it.

This would avoid the creation of Perpetual Debt and make shrinkage of the bank credit supply possible without causing mathematically inevitable defaults.

The "store of value" function of bank credit savings would be transferred into the Producer Credits. The result would be that much more conventional money would be available as a "medium of exchange", stimulating the economy and making banking far more stable.

2. Banks #1

Banks would collect commissions on the sale of Producer Credits instead of paying compound interest to savers. This would allow participating banks to:

a. lower interest rates on loans and/or;

b. increase their income.

Until the practice caught on, this would be a competitive advantage for participating banks.

To the extent that business borrowing of conventional funds would be replaced by Producer Credits, banks would lose that interest income. They would also lose the risk of default on what is often unsecured debt based on projected income, and the need for 8% capital adequacy on that credit.

3. Banks #2

In its place, banks would enter the Producer Credit brokerage business where all credit is 100% secured by the Producers themselves in real goods and services, not by banks with 3% backup in legal tender and or 8% or less of capital.

This Producer Credit brokerage business has many potential new sources of income (see 7). Entry into this business has already been recommended in detail, to the City of London in this report. The implementation recommended here would expand the scope of credit brokerage far beyond that envisioned in the report.

4. Savers

Savers would get savings that are:

a. redeemable for real goods and services from specific suppliers. Because the credit is a pledge of collateral, the saver is a secured creditor.

b. protected from both inflation and bank failure. Purchasers who redeem the Producer Credits for product or service at whatever time in the future, would be guaranteed approximately the same real value for their Producer Credit "money" as the Producer spent in conventional money initially. This is because the Producer Credit value unit is insulated from monetary fluctuations by defining it in terms of a basket of globally significant staple commodities, mostly energy, minerals and food.

5. Producers

Producers would be freed from any scheduled debt-of-money. Producers would get conventional money crowdfunding, on their own terms, the debt payable in their goods and/or services ONLY.

6. Purchasers

Purchasers redeeming their Producer Credits at maturity would receive a discount defined by the Issuer, in essence, earning an inflation-proofed dividend for the period the Credit was issued.

7.

Banks as Producer Credit Brokers

Brokerages / banks would earn income by facilitating transactions and maintaining the integrity of the credit. Brokerage would provide the following essential services:

a. Brokerages would enable convenient and even automated exchange of Producer Credits to provide the maximum return in real purchasing power to their clients. Purchasers would exchange the Credits they have earned or bought for the Credits they want to redeem for product at a discount.

b. Producer Credits would also be spent like conventional money with third parties. Brokerages would provide the accounting services as banks do in the conventional system.

c. For savers, brokers would offer portfolio diversification and management of turnover.

d. Due diligence by brokers would be required to ensure Issuers were reliable. By enacting two very common sense rules brokerages could become inherently honest (but not infallible) credit ratings agencies as their own best interests could only be served by honest evaluations.

All of the above are services today's banks could expand into that would ensure the smooth functioning of the new system and the security of the participants. Those services would most certainly be worthy of fees.

There seem to be win-win advantages for everyone.

Producer Credits would be a mathematical "relief valve" for the current system. The expansion into Producer Credits would enable the current system to become sustainable and stable and preserve itself.

Producer Credits would also enable deliberate shrinkage to a conservation and sharing economy that just might allow us to continue our existence on this Planet.

back / home