Solution page 6:

Does this method of valuation

create any distortion?

And exactly what is meant by the term "inflation"? Wikipedia

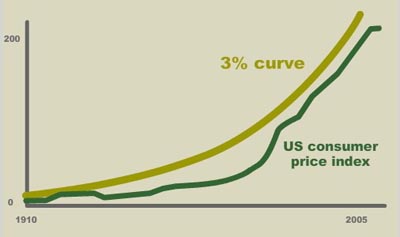

If the prices of all things rise more or less in proportion, that can be due to monetary inflation. More money has been created without a corresponding increase in real economic growth and the need for money. The powers-that-be actually target 1 to 3% inflation as a desirable policy. It's a hidden form of tax on savers that accrues to governments and whoever borrows it into existence and spends it first. Three percent annual devaluation means that our money's value is cut in half over a period of 25 years. The following chart adapted from data from the St. Louis Fed compares a mathematical 3% annual inflation curve with actual inflation in the USA from 1910 to 2005.

However, if oranges double in price due to freezing rain in Florida, that is not due to monetary inflation.

That is a real price increase. The price of oranges increases relative to everything else due to the current scarcity of oranges.

So our system of valuation should filter out monetary inflation while responding to any real increase in the price of oranges.

We start with the Rogers International Commodity Index (Wikipedia), the US-dollar value of a fixed basket of 38 world commodities that we shall use as our approximation of Q, the value of everything else to which we are comparing the value of our orange. If we choose to use 1000th of the Rogers International Commodity Index (RICI) as our definition, then our RICI unit could be $3.50 US at this moment in time.

For arithmetic simplicity, let's imagine these are exceptional oranges that currently sell for $3.50 US apiece. Therefore at this point in time, one orange costs one RICI.

If, in future, due to national currency inflation, the value of the same fixed basket of commodities (the RICI index) rises to 5000, then one of our proposed RICI units is defined as $5.00 USD. If the price of oranges in USD has risen in proportion to everything else due to monetary inflation, then the formerly $3.50 USD orange must now be priced at $5.00 US which is 1 RICI. The RICI price of the orange hasn't changed.

If, due to national currency deflation, the index goes down to 2500, the price of an orange would be expected to drop proportionately to $2.50 US = 1 RICI. Again, the RICI price of the orange stays the same, immune from the fluctuations of national currencies.

If the orange remains at the same price ($3.50 US) as before the deflation to 2500, then the orange has increased in price relative to the RICI basket of goods, which is a real price increase, not the result of monetary deflation. Its price is now 3.50/2.50 = 1.40 RICI.

If the RICI increases to 4,000 and the orange increases in price to $5 USD, then that orange, priced in RICI is 5.00/4.00 = 1.25 RICI.

Monetary fluctuations are filtered out, real price increases are not, precisely as would be expected.

Thus we have a very simple means available right now to create an inflation-proofed value unit that any alternative money system can voluntarily adopt. All it takes is global agreement on a value unit to take the first step towards making disparate systems globally compatible.