"Twice-Lent Money" page 4

Interest isn't the Problem... It's the Principal!

I claim there is a very simple mathematical proof of an inevitable cause of system collapse due to income disparity that builds up - even if all debts are PAID. This can happen in a complete absence of monetary interest. That cause is our concept of money as a thing-in-itself in finite supply.

Money can be lent more than once creating mathematically inevitable defaults if the demand for, or supply of, new loans diminishes. This is especially true when that thing-in-itself only enters circulation as debt, a promise of repayment in itself, which is what money is today.

What does it mean for money to be" twice-lent"? It's very simple.

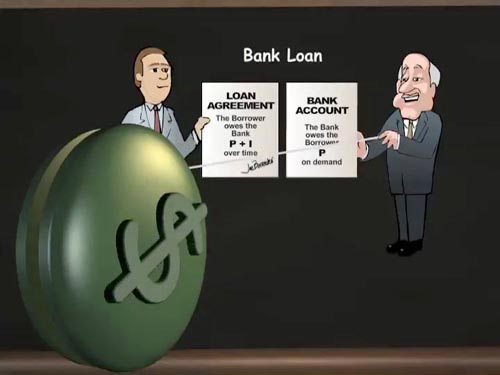

Money is created by banks as the scheduled debt of borrowers and is then:

1. lent again indefinitely to banks as the savings of depositors;

2. lent again indefinitely by depositors through money market funds offered by banks;.

3. lent again indefinitely by depositors privately.

If all money were created this way, is it not clear that, for the borrowers to pay off their loans on time, the depositors must spend their deposits so the borrowers can earn them on time?

As long as the borrowers' debt, which is now the depositors' money, remains lent to anyone... bank, money market fund, private lending, whatever, if it is LENT not SPENT, the only money available to be earned by the original borrowers to pay off the original debt will be Principal already commited to another loan.

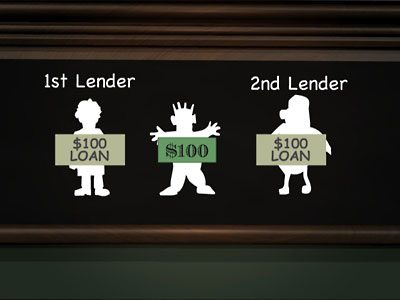

As a society, we are caught between lenders. This trap is invisible to us because we all, public, politicians and economists alike, ignore the fact that money is created as a debt cycle. We fail to see that when money is created as debt, savings put us in the position of owing the same money to two or more lenders simultaneously.

As a society, and invisible to us, we avoid default by borrowing from one to pay the other and vice versa.

This works just fine when the amount involved is stable or increasing. But... whenever a lender won't lend the full amount on time, or whenever the demand for money-creating bank loans slows down, for any reason, including natural cycles, someone must default. When a lot of people default it's a crash.

Imagine that 75% of all money created is perpetually unavailable except as a loan.

Only 25% is available to be earned debt-free.

Therefore, assuming the original borrower earns P and pays it back to the bank that created it, the original borrower had to use 0.75 P from someone else's P that they owe to a lender. So now that loan is short 0.75 P.

The original Principal Debt has been paid off with either:

1. new money created as someone else's debt or;

2. already-created money lent a second time.

This leaves those loans without the 0.75 P needed to pay them. Existing money must be lent or new money created to avoid default. Either way the next debt is short 0.75 P. We now have an ongoing dependence on the amount of 0.75 P never decreasing, and its delivery by the banking system as new money never slowing down. Otherwise default is inevitable.

Now, so far I have only mentioned a second debt of the same money. But there is no limit to how many times the same money can be lent in series making an unknown and perhaps unknowable number of loans dependent on the same Principal. If that number of loans in series were N then any shortage of new P could potentially be multiplied by N, causing multiple defaults of the same Principal ( NP ).

The chapter on Twice-lent Money from Money as Debt III

The Perpetual Debt Level is the total amount of money created that is not available to pay off the debt that created it, without creating a new debt. And, in the real world, amazingly enough, no one in economics that I know of has yet conceived of, much less tried to determine, the level of Perpetual Debt. And so far my repeated challenges to economists to refute the simple logic presented above continue to go unanswered. I was invited to write a paper, which I did, but nothing so far has come of it.

My paper published by the World Economics Association: "Proposed new metric: The Perpetual Debt Level"

back / next ~ M2 minus M1 is "Twice-lent Money"