|

|||

https://druthers.net/wp-content/uploads/2022/07/druthers-july-2022-resized.pdf page 9 Right click on image- choose "view image" - zoom in (control or command +) to read

https://druthers.net/wp-content/uploads/2022/08/druthers-august-2022-resized.pdf page 5

|

|||

Bitcoin and all such crypto-currencies are TheftThe simple and unavoidable truth is that such cryptocurrencies lay their claims on limited real world production in with the claims in conventional money of those who actually produced it. This is dividing the same pie into more pieces, the fifth piece being unearned, i.e. stolen. |

|||

my posted comments on the video presentations by economists and bankers It is not necessary to watch the videos to understand the comments. Part 1 / Part 2 / Part 3 / Part 4 "Throughout this panel discussion, I note that everyone,... slips into the habitual assumption that there is such a thing as “money” in our current system. I have had someone argue with me that “principal ceases to exist upon spending and fungible monies circulate in the national economy”. Logically, if “principal ceases to exist upon spending”, the borrower doesn’t need to pay it back after spending it. This is clearly not the case. And yet, nearly everyone unconsciously slides into thinking of money as a child thinks of a coin." "... the idea of “positive money” is absolutely pointless in an economy that must of necessity run on debt, ... The real question should be debt of what to whom?" A Critique of Design Options of Sovereign Money – a Full OverviewSovereign money reformers fail to examine what happens to money during its time in circulation, up to 30 years. Thus they fail to understand that the primary cause of negative outcomes is the multiple concurrent principal debts of the same money that accumulates over that time, an inevitable result of having one monopolistic form of money that is lent, earned and re-lent multiple times concurrently. Sovereign money reform as proposed by exclusionists can only exacerbate this problem because the fundamental principle of a single form of money made valuable by its own scarcity is the root of the problem. What is “Sovereign Money” and why do people think it’s a good idea?The thinking is that the need for money is determined by the gross volume of monetary transactions per unit of time. With the money supply centrally controlled as the central bankís monopoly, sudden inflation of the money supply, asset bubbles and crashes like 2008 would be impossible. The goal is commendable. But perhaps more thought is needed. It is my contention that, with the money supply centrally controlled as the central bankís monopoly, sudden inflation of the money supply and asset bubbles would indeed be impossible. But a crash or a very high rate of default would be caused for reasons sovereign money advocates havenít considered at all. Digging Deeper into Debt-Money

|

|||

Dear Mr. Grignon |

|---|

Basic explanations of what money really is

Where does Money Come From? (1 page PDF)

Is it "Money" or is it "Credit"? What is the Difference?

Peer-reviewed paper published by the World Economics Association:

(see my experiences with economists)

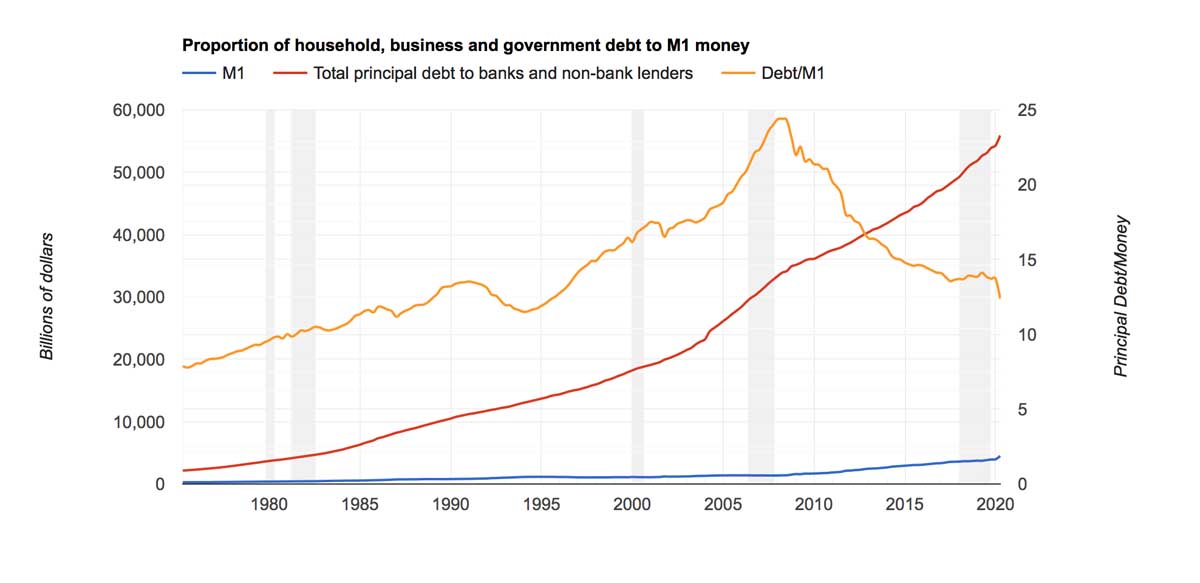

Proposed new metric: the Perpetual Debt

Level

Live-feed graphs of the US Perpetual Debt Level

see also Mari Werner's analysis at workableeconomics.com

Abstract

It is my contention that a critical metric in economics is missing. I call it the Perpetual Debt Level. This is the amount of bank credit money in circulation that is not available on time nor free of any other debt, to extinguish the debt to a bank that created it. This creates a borrow from Peter to pay Paul and vice versa Perpetual Debt situation in which the amount of the principal involved can never shrink, and the timing of its delivery can never slow down without causing mathematically inevitable defaults. Therefore, to avoid such defaults, it is, in practice, necessary to maintain growth of the money supply at all times. (1) I further claim that there is no escape from this destructive arithmetic problem within the concept of money as a quantity of a thing-in-itself, and especially within the current practice of money created as a debt-of-itself. The only remedy is radical, a total transformation of our concept of money.

Papers invited by Hypothesis Journal vigorously blocked by over 150 economists:

Money hypothesis 1: why our current money system is unstable

Money Hypothesis 2: a different concept of money

The main reason given for rejecting my analysis was that I quoted the actual rules of banking from the websites of 3 central banks as my references rather than quote previous papers by economists. The main objection to my proposed alternative is that "It would require change". Seriously... economists rejected my analysis because it is based on documented facts"from the horse's mouth" and rejected my proposal for change because it would require change. What can one do with people like that?

(see my experiences with economists)

ANALYSIS

Analysis of Banking (html)

The Banking System, Itself, is the ROOT CAUSE of Money System Instability

by Paul Grignon

In this article, I set out in words the argument that I present in Money as Debt II - Promises Unleashed. I claim that the design of the banking system itself necessarily creates an ongoing shortage of Principal that results in INSTABILITY and potential COLLAPSE of the system in the absence of PERPETUAL DEBT GROWTH. I claim that this occurs, even in the theoretical case of a COMPLETE ABSENCE of INTEREST and with ALL PAYMENTS BEING MADE in full and on time.

HOW is Principal Extinguished? (html)

The idea that money can be "extinguished" is not intuitively understood by most people.

Does somebody burn cash or something like that?

For most people, the mental concept of money is that it is a positive thing, probably due to the use of debt-free coins for millennia. This is constantly reinforced by our own experience. We successfully trade paper cash and digits in an "account" for food, shelter etc. just as we once traded gold and silver coins for things. We continue to perceive money as something with a positive lasting physical nature, which it no longer is, in reality. Today's debt-money is a time contract for self-extinguishment, existing for only as long as the debt that created it exists.

The Confusion About Savings (html)

No one disagrees that banks create money from the borrowers’ promises to pay it back. However, disagreement arises when one side claims that Banks NEVER lend their depositors’ money. This side claims that banks always create new money against new debt. According to this side of the argument, Principal Debt within the banking system can never exceed the Principal created by that debt.

P of money = P of debt that created it.

The other side of the argument claims that banks ALSO effectively lend the depositors’ money deposited (ie. loaned to the bank) in savings accounts, thus lending the same money twice and creating a fundamental shortage of Principal.

P of Principal < 2P of debt of that Principal.

The first side claims that if the banks always create new money against new debt the second claim cannot be true. The following demonstration will explain why that reasoning is in error. Both are true. There is no contradiction. There is only a misunderstanding of what savings really are.

Money and Politics: Incorrect Diagnosis, Wrong Cure (PDF)

I believe that it is imperative to change what money IS in the interest of not destroying what is left of our planetary life-support systems.

And... I suspect it is safe to say that, unless money is fundamentally re-structured, politics never will be.

An answer to Claudio Borio's Call for a new explanatory model

I suggest that a sufficient explanatory model is more easily constructed than the author imagines. It was first published in 2009 as animated flow diagrams within Money as Debt II - Promises Unleashed, my animated feature movie (77 min) widespread online.