|

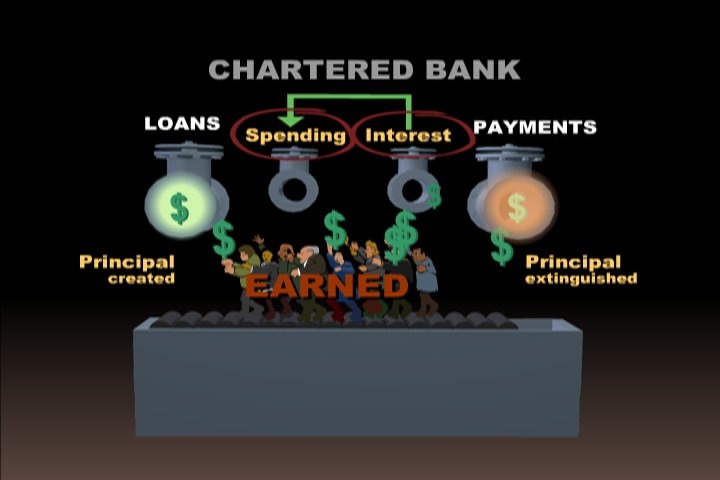

essays / site map / view all movies / contact The Banking System, Itself, is the ROOT CAUSE of Money System Instability 1.THE INTEREST WAS NOT CREATED Why is our money system unstable? I claim that THE DESIGN of the BANKING SYSTEM itself, is the ROOT CAUSE of MONEY SYSTEM INSTABILITY. In this article, I set out in words the argument that I present in Money as Debt II - Promises Unleashed. I claim that the design of the banking system itself necessarily creates an ongoing shortage of Principal that results in INSTABILITY and potential COLLAPSE of the system in the absence of PERPETUAL DEBT GROWTH. I claim that this occurs, even in the theoretical case of a COMPLETE ABSENCE of INTEREST and with ALL PAYMENTS BEING MADE in full and on time. Here is the definition of stability from the dictionary. This definition will be referred to throughout. stable, adjective Instability, in common language, means the lack of any one, or all, of these features. THE INTEREST WAS NOT CREATED These money reformers ask "Where does the money come from to pay the Interest if it wasn't created?" It is common to state this as Total Debt (Principal only) = Principal + Interest, and claim that there has to be an absolute shortage because Principal is always LESS than Principal + Interest, for any amount of Interest. This is commonly expressed as an INEQUALITY, P < P + I where (I) represents the TOTAL interest paid. According to this misapplied INEQUALITY, there must be a shortage equal to the full amount of the Total Interest paid (I). But P < P + I is a static expression. It only applies to the TOTAL PAID after the loan is finished. P < P + I does not take into account the fact that payments are normally made over a period of time. And... Interest is NOT extinguished when paid. Only Principal is.

The Principal paid as Interest still exists. It can be spent by the lender and can be earned again by the borrower. In fact, Interest can be recycled as "spend-earn-pay-again" any number of times, allowing just the Principal of the loan itself to pay P + I. This is mathematically provable as I have done with easy-to-understand animated flow diagrams in Money as Debt II and III. If you still struggle with the idea, just pass a dollar from one hand to the other 10 times. In a closed loop, each loan can be entirely self-sufficient for both Principal + Interest because the Interest recycles (flows) as spending.

ALL THE MONEY IN THE WORLD WHY? Because at any moment you need to pay Interest, THERE IS ALL THE MONEY IN THE WORLD TO DRAW FROM TO PAY THE INTEREST. The idea of some inevitable real shortage of money IN EXISTENCE to pay the interest because P < P + I is a total illusion!! More than enough money exists to pay the Interest. The pertinent (and limiting) issue is... is it available to YOU to be EARNED? All money is someone's Principal. And anyone's Principal can be temporarily and repeatedly used to pay anyone's Interest, because interest is not extinguished. Therefore, successful payment of interest can NEVER produce the only significant mathematical shortage there can ever be, which is a shortage of Principal with which to extinguish Principal Debt. SHORTAGE OF PRINCIPAL? Therefore, there can NEVER be a mathematical shortage of Principal to pay the Principal Debt due to the paying of interest, simple or compounded. So, where is there any structural shortage of money? That remains to be shown. NON-PAYMENT IS A PRIMARY CAUSE OF INSTABILITY Because of Interest, DEBT-AT- INTEREST, left UNPAID, will GROW by COMPOUNDING to INFINITY. Instability due to the compounding of unpaid debt is easily observable in the near-universal phenomenon of mounting government debts and impending defaults at national, state and municipal levels. This is because many governments have been financing themselves by means of the Ponzi Scheme of ever-increasing bond issues, selling MORE DEBT to pay off PAST DEBT.

In the case of federal government debts, some of the government debt is bought by the central bank with new "legal tender", which is physical paper cash, and credit for same at the central bank. This is the mechanism by which new legal tender is introduced into the circulation. Recently, as a response to the "debt crisis", the Federal Reserve, and other central banks, introduced an unprecedented amount of "central bank credit for legal tender" into the system.

In this way non-payment of government debt not only burdens taxpayers to pay exponentially-increasing interest forever on that ever-growing debt (lack of equilibrium, growth to infinity), it also has the potential to rob those taxpayers of their purchasing power by means of perpetual "inflation" i.e. the perpetual devaluation of "legal tender"(lack of equilibrium, prone to change). However in most other cases, non-payment of debt is never actually allowed to grow to infinity. Instead it results in default and seizure of collateral, or the "lender" simply taking a loss. Thus most debts do not grow to infinity in real life. At some point they are defaulted upon.

The system would also fail due to NON-PAYMENT even if no interest were to be charged. Thus the cause of instability is NON-PAYMENT, (money supply prone to sudden change and failure), which should be no surprise, obviously. However, in a debt-money system, UNRELIABLE DEBT undermines the confidence needed to create the bank credit money we depend on. Unlike the money supply being a pile of gold coins ALREADY PRODUCED which doesn't vaporize due to bad system design and still exists without the system, there is, in the bank credit system, only a pile of IOU's. These IOUs can ONLY exist within the system. In addition, these IOU's are just promises of legal tender that is almost entirely non-existent. And, because "legal tender" is only created to buy DEBT, usually only federal government debt, the missing legal tender, IF DEMANDED, must be supplied by increasing the TAXPAYERS' DEBT. Legal tender is actually nothing more than pieces of paper printed to buy unpayable Ponzi-scheme TAXPAYER DEBT. Therefore, the entire system is subject at all times to the possibility of catastrophic failure due to the NON-PAYMENT of typed-in numbers that represent PROMISES of pieces of paper, most of which DO NOT EXIST. These pieces of paper themselves are the result and evidence of a Ponzi-scheme that DEPENDS on the CONTINUOUS GROWTH OF TAXPAYER DEBT forever into the FUTURE. Thus taxpayers are forced to RENT THE MONEY that represents their own productivity and GO FURTHER into DEBT FOREVER for the privilege. This does not sound like a recipe for stability. And when it all fails, the banks get BAILOUTS, MORE TAXPAYER DEBT. The TAXPAYERS are the LENDER of LAST RESORT, called upon to replace, from their own real productivity, bankers' promises that were empty in the first place.

Yes, as we have all been told, the value of our money rests on "the faith and credit of the nation". In reality, that means the ability to TAX US, ultimately at the point of a gun.

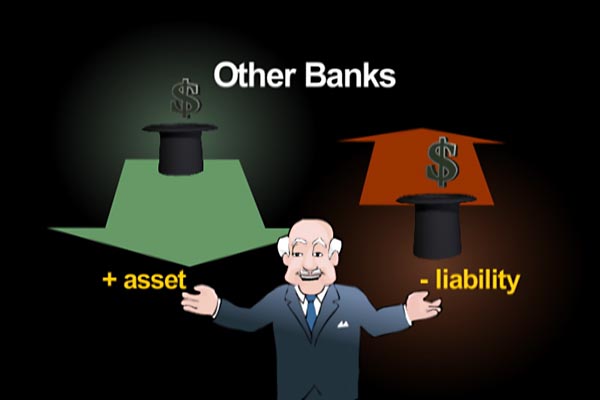

MORALITY IS NOT THE ISSUE HERE - THE DESIGN IS "SAME MONEY LENT TWICE" (diagrammed explanation) I claim that there is an all-inclusive description of ALL the other causes of system instability. This description includes compound interest growing to infinity and every case of lending existing Principal. I call it "Same Money Lent Twice". PRINCIPAL "LENT TWICE" IN A CHAIN 1. PRINCIPAL is borrowed (created) from a bank by A; 2. A lends PRINCIPAL to B. Bank lends to A, A lends to B. 3. A's LOAN = B's DEPOSIT. There is NO SHORTAGE OF PRINCIPAL lent in a chain; B must pay A, and A must pay the bank. The Principal has effectively only been "lent once" through the intermediary A.

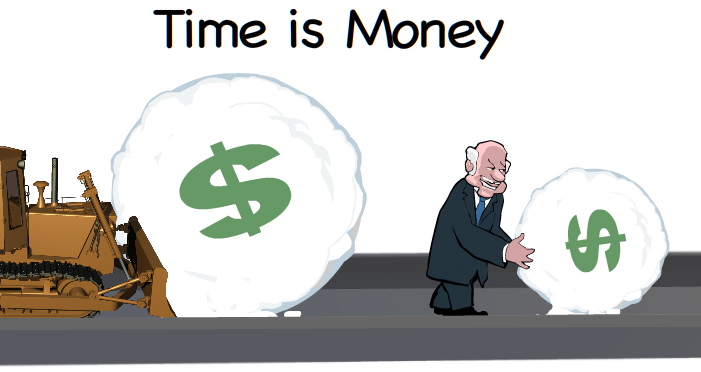

1. PRINCIPAL is borrowed from a bank by A. 2. PRINCIPAL is spent by A. 3. PRINCIPAL is earned by B. 4. PRINCIPAL is deposited by B at a bank, in other words, B has LENT the Principal to the bank. The Principal is now Principal "lent twice". Once by the bank to A. And a second time by B to the bank. But, there is NO CHAIN. Bank lends to A, A spends, B earns, B lends to Bank. As before... A's LOAN = B's DEPOSIT but B has no obligation to pay A as B has EARNED the PRINCIPAL. But, as before, A must pay the bank. Where can A obtain the Principal? As before, only from B. What if B (the DEPOSITOR) only wants to LEND the PRINCIPAL , NOT SPEND IT? What if the DEPOSITOR wants to grow his/her SAVINGS by COMPOUNDING to INFINITY? COMPOUND INTEREST IS ALSO "SAME MONEY LENT TWICE" ALL DEBT-PRINCIPAL IS LENT TWICE Therefore, all money created as one loan and spent, must, of necessity, either be withdrawn as cash, "legal tender", or "deposited" at a bank. Almost all "money" is actually "bank credit" deposited at banks ie. LOANED to the bank. Depositors are lending existing bank credit money already created as the DEBT of some borrower (LENT ONCE) back to the bank that created it (LENT AGAIN) Therefore, ALL BANK CREDIT MONEY created as LOANS is, by necessity of the system design, "SAME MONEY LENT TWICE". BANKS CREATE MONEY vs. BANKS LEND DEPOSITORS' MONEY Here is a detailed description of the full loan and repayment structure of the banking system, as I understand it. STEP 1. The borrower promises the bank FUTURE repayment in legal tender and/or bank promises to pay legal tender, ie. "bank credit".This may or may not be backed up with collateral that the bank may seize and sell to compensate for non-payment. STEP 2. The bank Promises legal tender it does not have and does not have the resources to obtain without borrowing. Therefore the CURRENT EQUITY VALUE of the BANK'S PROMISE is somewhere close to ZERO. STEP 3. The borrower ACCEPTS this ZERO in exchange for his/her FUTURE VALUE (repayment) and spends it NOW. The CURRENT EQUITY VALUE of the borrower's promise is also ZERO as the borrower has DONE NOTHING YET TO EARN THE CREDIT. STEP 4. Real Production in the World ACCEPTS this ZERO for VALUE and provides the borrower with GOODS and/or SERVICES NOW. This ACCEPTANCE FOR VALUE by society is what turns the bank's promise worth NOTHING and the borrower's promise of FUTURE REPAYMENT into MONEY, a DEMAND for REAL VALUE NOW. The goods & services exchanged for this NOTHING now make that MONEY EARNED. We all know what would happen if we all simultaneously demanded payment in physical cash and coin. The bank doesn't have it. It doesn't even exist. So why do we accept these obviously fraudulent promises? Because the bank offers a service, a "system" that is far more convenient and secure from theft and loss than cash. STEP 5. The DEPOSITOR, having given REAL VALUE for NOTHING, has EARNED IT and IMPARTED REAL VALUE to this "money". The Commercial Law System ENFORCES DEBTS that have been exchanged for REAL VALUE.("consideration") Because there is NOWHERE TO KEEP BANK CREDIT EXCEPT AT A BANK, the DEPOSITOR is FORCED by the DESIGN OF THE SYSTEM, to: A. CLAIM LEGAL TENDER from the bank, (a small proportion exists in this form- typically 1-10% in developed countries) OR... B. LEND (same money lent twice) the EMPTY PROMISE back to the bank as a "DEPOSIT", thus DEFERRING THE NEED for the BANK TO MAKE GOOD on its EMPTY PROMISE of legal tender. This INDEFINITE DEFERRAL of DEMAND for LEGAL TENDER (SAVINGS) is what makes it possible to create a DEMAND for REAL VALUE NOW from a BORROWER's promise of FUTURE PAYMENT (DEBT) without having the LEGAL TENDER. STEP 6. The DEMAND FOR PAYMENT IN LEGAL TENDER is only DEFERRED for as long as the DEPOSITS (SAVINGS) that BALANCE the initial LIABILITIES, are NOT WITHDRAWN from the banking system in legal tender notes and coins. Thus, bank lending is completely dependent on depositors, just as if it were lending out depositors' money. And the bank "profits" only from the "spread" between the interest paid to depositors and the interest collected from borrowers just as if it were lending out depositors' money. But the bank isn't lending out depositors' money. It is deferring its unfunded obligations to pay legal tender by having depositors lend these obligations back to the bank. Money has been CREATED AND SPENT, EARNED AND DEPOSITED, with NO PRESENT VALUE to back it, and the banking system has NO NET LIABILITY, for as long as DEPOSITORS DO NOT DEMAND LEGAL TENDER. WHAT IS THE FINAL SITUATION HERE? Superficially, it looks exactly the same as a CHAIN. The borrower has borrowed the $1000 from the depositor via the bank . But that is NOT the case because... where did this $1000 come from to begin with? The borrower promised the bank repayment IN THE FUTURE. Its PRESENT VALUE is ZERO And the bank doesn't have the legal tender it promised, so the value of its promise is also ZERO. Therefore, THERE IS NO $1000 NOW. There is a CURRENT LACK OF $1000 created simply by the bank promising $1000 of legal tender the bank does NOT HAVE and having that empty promise "deposited",(twice lent) that is to say NOT DEMANDED in legal tender. (disequilibrium, prone to change of condition, prone to failure, easily disturbed, not self-restoring) IS THIS AN ACTUAL SHORTAGE THAT DE-STABILIZES THE SYSTEM? Systemically, it can be ONLY from the DEPOSITOR. Therefore, IF the DEPOSITOR withdraws the $1000 and SPENDS it so that the BORROWER CAN EARN it, the problem is SOLVED. The debt of the borrower to the bank is eliminated in tandem with the debt of the bank to the depositor (equilibrium). The flow of "fake funds" is completed and no one was the wiser or worse off. The borrower repays it to the bank-of-origin and THE UNFUNDED LIABILITY of the BANK is safely ELIMINATED. Note that this is functionally the same as if the borrower had bought something from the depositor directly and the depositor let the borrower "work off" the debt, so it is also fair and equitable, even though the bank created the money from "nothing". (provided all consideration of bank fees and interest are set aside!) The full sequence: BUT...NOW THAT MONEY IS GONE. And THE ONLY WAY TO FULLY REPLACE IT IS WITH ANOTHER LOAN at least as big. Extreme Scenario 1: FULL REPAYMENT Extreme Scenario 2: NON PAYMENT If ALL DEPOSITORS saved their DEPOSITS, DENYING them to ALL BORROWERS, ALL BORROWERS WOULD DEFAULT and, ALL COLLATERAL would be FORFEITED. Collateral Values would plunge and BANKS WOULD GO UNDER. The system would collapse. (disequilibrium, failure). In this DEBT MONEY system, BOTH excessive RE-payment and excessive NON-payment of DEBT have the potential to cause instability and collapse of the system. GROWTH TO INFINITY IS ADVERTISED And, as SAVERS, WE EXPECT OUR MONEY to LAST FOREVER, and, with interest, actually GROW by compounding (same money lent twice) potentially to infinity. BUT, In reality, for the system to function in equilibrium, THIS MONEY MUST BE SPENT , EARNED by the BORROWER and EXTINGUISHED by a certain TIME. Principal growing to infinity through SAVINGS deposited for an indefinite length of time, which is an advertised feature and incentive of the system, is in direct conflict with the borrower's need to extinguish this Principal by a very definite time. (disequilibrium, prone to failure). As I put it in Money as Debt II, anyone rolling their Principal like a snowball to make it bigger is PREVENTING that PRINCIPAL FROM BEING EARNED debt-free by borrowers who need it to EXTINGUISH the DEBT that CREATED that PRINCIPAL.

If the DEPOSITOR does NOT SPEND any of the DEPOSIT in such way that the BORROWER CAN EARN that money, the equations that describe this situation are: BORROWER DEBT to BANK = $1000 BANK DEBT to DEPOSITOR = $1000 THEREFORE TOTAL DEBT = $2000 (2P) TOTAL PRINCIPAL IN EXISTENCE = $1000 (P) THERE IS A 100% SHORTAGE OF PRINCIPAL IN THE SYSTEM. WHY? Because, unless all deposits are spent so that the borrowers can earn them, which is the only way the system can avoid mathematically inevitable defaults, the only way all debts can be paid, is to promptly create $1000 of NEW PRINCIPAL . But this will just RE-CREATE THE SITUATION described. So each new $1000 of created PRINCIPAL necessitates the NEXT $1000 of created PRINCIPAL to promptly follow it WITHOUT FAIL, FOREVER. (disequilibrium, prone to failure) It is solely due to the INEQUALITY of Principal (P) being one half of Debt (2P) that creates an ongoing 100% shortage of Principal that requires constant replacement with new Principal and has nothing to do with the arithmetic of interest. Mathematically inevitable defaults result solely from money creation slowing down. (periodically inevitable, thus prone to failure) The mistaken argument is to say that because all loans contain all the money needed to pay them off, both Principal and Interest, then LOANS P = DEPOSITS P. Both sides of this equation should be able to increase or decrease together without causing mathematically inevitable defaults. (equilibrium) But this is not the real situation. There are TWO debts of Principal. LOANS 2P ≠ DEPOSITS P is an INEQUALITY that has only ONE resolution. The DEPOSITS (bank debt to depositors) must be SPENT and the BORROWER must EARN this "bank credit" and pay it back to the bank-of-origin to EXTINGUISH the bank-of-origin's exposure to a DEMAND for LEGAL TENDER the bank never had. BUT that "resolution" results in ELIMINATING THE "MONEY" FROM EXISTENCE, thus necessitating a NEW LOAN to replace it anyway. (prone to failure)

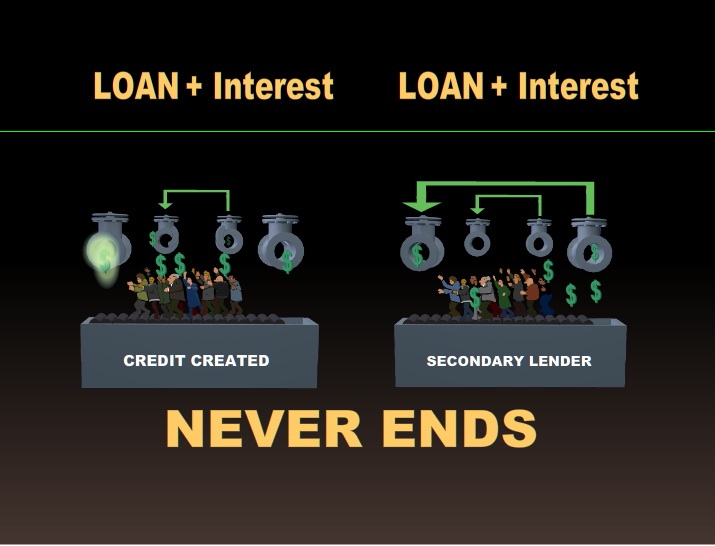

Therefore, it is ESSENTIAL that , systemically, FULL REPAYMENT OF DEBT must NEVER HAPPEN. To maintain a stable money supply, TOTAL DEBT MUST NEVER DECREASE and to prevent mathematically inevitable defaults, NEW DEBT-CREATION must NEVER SLOW DOWN. IF NEW MONEY CREATION SLOWS BELOW THE RATE OF PRINCIPAL REPAYMENT (destruction), DEFAULTS ARE MATHEMATICALLY INEVITABLE (disequilibrium, failure, default) due to the mathematical design of the banking system itself, working as designed, all payments made and in the complete absence of interest. This also was explained with animated diagrams in Money as Debt II. Here I have created a special version of this animation for this web page.

This explanation is consistent with the observation in the real world that instability becomes a practical problem whenever there is a SLOWDOWN in the GROWTH OF DEBT. If new borrowing fell to ZERO, the bulk of the money supply would soon disappear. (disequilibrium, not self-restoring, prone to large changes, likely to fail)

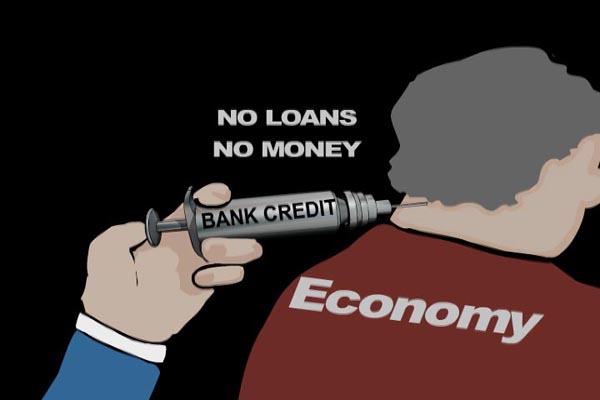

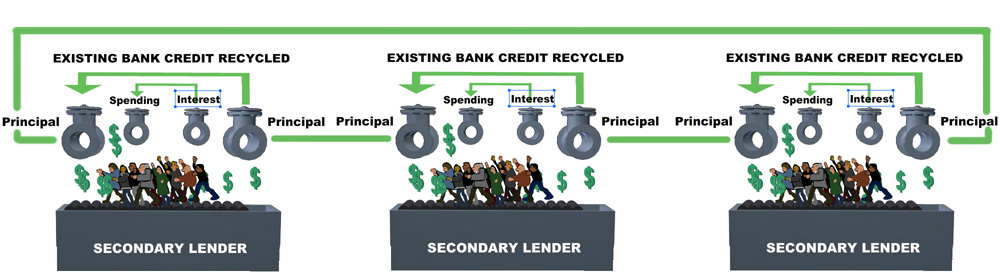

This should be obviously true. Money is DEBT. Therefore NO DEBT = NO MONEY (not permanent, extremely elastic, prone to large changes, likely to fail) as stated repeatedly in Money as Debt. Very clearly, in a DEBT-MONEY SYSTEM, BOTH EXCESSIVE NON-PAYMENT and EXCESSIVE RE-PAYMENT CAUSE SYSTEM INSTABILITY. ONLY CONTINUOUS NEW MONEY CREATION THAT KEEPS PACE WITH CONTINUOUS PRINCIPAL REPAYMENT CAN MAINTAIN SYSTEM STABILITY. INHERENT GROWTH IMPERATIVE Why? Because every time increased borrowing INCREASES the TOTAL AMOUNT of PRINCIPAL in the system, ANY DECREASE tends to cause MATHEMATICALLY INEVITABLE DEFAULTS (disequilibrium, not self-restoring, prone to large changes, likely to fail) Therefore, EVERY INCREASE IN THE TOTAL MONEY SUPPLY(DEBT) IS A ONE-WAY CHANGE. It is a PERPETUAL DEBT GROWTH "RATCHET EFFECT". We have an "inherent" mathematical feature of the system, which is the original act of making money out of ZERO with "Twice-lent Money" that makes continuous growth of DEBT the only sure way to avoid "MATHEMATICALLY INEVITABLE DEFAULTS" and LOSS OF COLLATERAL ON A MASSIVE SCALE. Keeping money DEPOSITED at a bank, instead of spending it, tends to create mathematically unavoidable defaults any time new money creation slows down, (disequilibrium, not-self-restoring, prone to large changes, likely to fail) which it always does periodically when, collectively, borrowers can no longer increase their debts. Being unable to add to our debts is not necessarily a result of interest. We would all reach the limits of our income even if the Principal were interest-free. Therefore, functioning perfectly, and with all debts paid on time, a workable system should be designed to cope with inevitable slowdowns of TOTAL borrowing. But the current system is not and could never be, even if interest were eliminated. A slowdown of new DEBT CREATION tends to result in mathematically inevitable defaults, potentially on a massive scale, even in the COMPLETE ABSENCE OF INTEREST. (disequilibrium, not-self-restoring, prone to large changes, likely to fail) The only solution is for DEPOSITS to be SPENT, EARNED by the borrowers and EXTINGUISHED as Principal Payments to the bank-of-origin. But THIS WOULD ELIMINATE ALMOST ALL MONEY AND NECESSITATE NEW LOANS ANYWAY. There is no escape from the treadmill. ARE ALL DEPOSITS AVAILABLE TO BE EARNED BY BORROWERS? For one reason, when the economy slows down, reducing new-money borrowing, spending of deposits normally DECREASES. The exception, the poorest, will HAVE TO withdraw any savings they have, and spend them. But most people will "hold on to their money" out of fear. It remains DEPOSITED. And some of these SAVED DEPOSITS could be loaned out by "SECONDARY LENDERS" MAKING EXISTING-MONEY LOANS, and each time this money is loaned, it theoretically may be spent, earned and loaned again. If rolled over ad infinitum, this bank credit will NEVER be available to the original borrower, except as another LOAN. In the real world, where interest IS charged on loans, non-bank lenders, for the most part, will be attempting to GROW their PRINCIPAL by compounding at least some of the Interest collected into additional money to lend (same money lent yet again). Therefore, the lending capital of these non-bank lenders may GROW INDEFINITELY and NONE of it will EVER be AVAILABLE to be EARNED systemically debt-free by the original borrowers of the Principal. It will ALL have to be BORROWED first by someone in order to be available in circulation to be EARNED by the original borrower, paid back to the BANK, and EXTINGUISHED. But that does NOT EXTINGUISH the DEBT to the SECONDARY LENDER. There is now a DEMAND for the FULL AMOUNT of the PRINCIPAL and NO PRINCIPAL IN EXISTENCE WITH WHICH TO PAY IT. Again, we have the same situation, the only way to make current payments in the system is that someone must take out A NEW MONEY-CREATION LOAN AT LEAST AS BIG. Because this NEW LOAN is also created from DEBT it just re-creates the situation. Therefore, the loan replacement process must GO ON FOREVER WITHOUT FAIL. (disequilibrium, prone to large changes, likely to fail) THERE IS NO RESOLUTION for as long as these SECONDARY LENDERS LEND and DO NOT SPEND their Principal so that the original money-creation BORROWERS CAN EARN IT. This PERPETUAL DEBT can never be eliminated NOR EVEN REDUCED without mathematically inevitable DEFAULTS.(lack of equilibrium, prone to failure). SIMPLE INTEREST PAID N times is UNBOUNDED if N is UNBOUNDED BUT... theoretically the same Principal can be lent, spent, earned, lent again, spent, earned, lent again, N times. There is NO absolute arithmetic shortage of Principal in this case, despite the multiple loans. This is because, as a purely mathematical possibility, we can borrow from Peter to pay Paul and vice versa ad infinitum to avoid default. This is because the Principal of a non-bank lender is NOT extinguished when repaid. Like Interest, it can be recycled, but it must be as an immediate replacement LOAN or SPENDING, because each loan in the series depends on the same $1000 of Principal to be available.

Here is where we could inject a lot of real world "for whatever reasons" this will never work. The more that Principal is re-LENT the more the complexity multiplies. The risk of defaults increases because the timing and logistics become impossible in practice. SPENDING or GIVING the Principal away is the only escape. However, for this mathematically pure model, despite the obvious logistical difficulties, and the real world likelihood that the private lenders will roll some of their interest earnings into new Principal to lend (same money lent twice... again) and some borrowers will be late, thus compounding their debts (same money lent twice... again) IT IS ASSUMED THAT ALL THESE DEBTS DO GET PAID. However, they DON'T GO AWAY. The Principal created and due back for payment at the bank-of-origin has been permanently diverted into an ONGOING ROLLOVER of DEPOSITS as lending capital, never to return to the loan cycle that created it except as a LOAN of existing PRINCIPAL. Every time a new endless cycle of Principal rollover is added, it increases the TOTAL DEBT LOAD permanently, unless the Principal is SPENT or GIVEN AWAY.

Here, the potential problem is PERPETUAL UNBOUNDED PRINCIPAL DEBT (same money lent twice and more) accompanied by PERPETUAL UNBOUNDED SIMPLE INTEREST, and that is assuming ALL of it is PAID as required (disequilibrium, not-self-restoring, prone to large changes, likely to fail). If any of it is not paid on time we can add COMPOUNDING (same money lent twice and more) interest charges as well. And when new money borrowing slows down, for every dollar of NEW Principal NOT created in time by a bank, there will be a one dollar shortage of Principal that is multiplied by the UNBOUNDED NUMBER (N) of loans dependent on that Principal. (disequilibrium, not self-restoring, prone to large changes, likely to fail). This AMPLIFIES the effect of ANY SLOWDOWN in NEW PRINCIPAL CREATION. At some point, this parasitic interest burden, although still mathematically possible to pay in theory, will be, in practice, IMPOSSIBLE TO PAY. The burden will be too great. The interest parasite will kill the host, ie, the unbearable demands of finance will destroy the productive economy that gives any money its value. This creation of Perpetual Debt by means of NON-BANK LENDING of existing Principal, and the multiplication of loans, and therefore the the multiple Interest burdens on the same Principal, was explained in Money as Debt II - Promises Unleashed

BANKS CAN CREATE MONEY TO BUY ANYTHING! Is there some "cushion" of extra money that keeps the system from collapsing the moment borrowing slows down even slightly?

Yes there is. The same mutual clearing of credit between banks that allows banks to make loans without the legal tender, also allows banks to buy REAL THINGS with credits the bankers just "type in". This introduces new bank credit money into the system that does NOT have to be paid back and extinguished, thus providing a "cushion" of extra Principal to the money supply. Banks can create liabilities against themselves to buy anything, as long as they do it in concert. As with loans, every bank still needs the incoming deposits to offset the outgoing liabilities. However, SPENDING NEW LIABILITIES ON OPERATING COSTS would unbalance the bank's books because there would be NO ASSET TO BALANCE THE LIABILITY. Only the purchase of EQUITY gives the bank an asset on its books to balance the liability spent. Perpetual Gain in money VALUE is expected from equities so the pressure for perpetual growth moves from the arithmetically rigid money system into the flexible non-guaranteed valuations of equity. The hard chains of fixed repayment become elastic expectations. However, much of this "extra money" circulates entirely in the "casino" of equity speculation. It exists, but only in the gambling sector of the economy. It is never available to the ordinary borrower. Only money invested in "buy and hold" investments is likely to be spent on capital goods, wages etc, so that ordinary borrowers can earn it. And, of course equity can go down in value as well as up. When borrowing slows down, the value of equities usually shrinks as there is less money chasing the same equities. Therefore, just when this "cushion" is most needed, it shrinks and could even put the bank in a negative balance position where liabilities exceed the market value of assets bought with them. In any case, when banks buy equities, the bank's risk is taken in the stock and bond and real estate markets. If banks all pile in to a class of investments together, the extra money can create a bubble of overvaluation, that must eventually crash. This can leave banks having to mark-to-market their assets at a LOSS. (subject to sudden or extreme change or fluctuation, prone to failure, easily disturbed, not self-restoring) On the SOCIAL FRONT, people are becoming aware that the banking system gives the banks FREE REIN acquire REAL VALUE with EMPTY PROMISES. If banks do NOT do so, such as when equity values are generally falling,(serious real estate and stock market declines), the government must step in and issue NEW LIABILITIES AGAINST THE TAXPAYER (BAILOUTS) to make up for the functional shortage of Principal. People are beginning to understand that they are collectively TRAPPED INTO PERPETUALLY ESCALATING DEBT that can NEVER BE PAID OFF, with NO ESCAPE except to let the banks seize our COLLATERAL in default, or create even more empty promises with which they can then BUY UP OUR DISTRESSED PUBLIC PROPERTY. The 'enclosure of the commons' begun centuries ago, continues. One might expect "political and economic instability" to be the logical result. Witness current events in Greece, where banks will collectively create brand new debt-money to buy up, privatize, and "enclose" the public property of all Greeks.

1. Twice-lent Principal is fundamental to the design of the banking system. System-wide, "DEPOSITS of money created from debt" BALANCES OUT "money created from DEBT". This is assured to happen BY SYSTEM DESIGN. But as a result, PRINCIPAL DEBT = 2 x PRINCIPAL in existence. This inequality is the "sine qua non" of the banking system. Banks can create new money as promises they cannot fulfill, ONLY so long as those empty promises are lent back to the banks by depositors, thus deferring the banks' obligation to fulfill them with legal tender indefinitely into the FUTURE. Principal created from DEBT by banks is the ROOT CAUSE of system instability. (subject to sudden or extreme change or fluctuation) There is a systemic, ongoing SHORTAGE OF PRINCIPAL that can only be permanently remedied by the DEPOSITORS SPENDING 100% of DEPOSITS SO THAT BORROWERS CAN EARN THEM and EXTINGUISH THEM. But that MUST NEVER HAPPEN because it would eliminate the bulk of bank credit money in existence and leave the world with almost NO MONEY! (disequilibrium, not-self-restoring, prone to large changes, likely to fail) MONEY IS DEBT. Therefore, NO DEBT = NO MONEY 2. By design, the stability of the money supply is therefore dependent upon PERPETUAL DEBT RENEWAL, and with the ratchet effect, PERPETUAL DEBT INCREASE . This is because mathematically inevitable defaults tend to be caused whenever debt growth slows down, even in the theoretical case of a complete absence of interest. 3. Mathematically, SIMPLE INTEREST charged on LOANS, if 100% SPENT by the LENDER, could never be a mathematical problem in itself. 4. Persistent NON-PAYMENT OF DEBT-AT-INTEREST leads to UNBOUNDED DEBT GROWTH by means of COMPOUND INTEREST. 5. NON-PAYMENT itself is an obvious cause of instability. However, FULL RE-PAYMENT would be "system suicide" as it would ELIMINATE the MONEY society needs to function. 6. “Inherent debt growth to infinity” is an advertised feature and incentive of the banking system that sells us on the idea of compound growth of SAVINGS (bank debt to depositors). SAVINGS NOT SPENT is the fundamental systemic cause of Loans NOT being REPAYABLE without NEW LOANS. 7. Principal-at-simple-Interest can be loaned N times by secondary lenders, where N is theoretically an UNBOUNDED NUMBER. Therefore the interest that must be paid on these loans is also a theoretically unbounded number, even without compounding; 8. "Same Money Lent Twice" is a simple and fundamentally accurate description of ALL identified causes of instability due to the system design of banking. 9. Banks, collectively and in tandem, can create for themselves FREE money to buy equities. This is the source of "extra debt-free money" that prevents system failure. When equity values FALL, bank liabilities may exceed the value of the equities the banks own, putting the banks into a "loss" position. 10. When all else fails, the system can only be saved by government BAILOUTS which means the creation of NEW DEBT-MONEY "funded" from NEW TAXPAYER DEBT-AT-INTEREST In many cases, this taxpayer debt is clearly absurd and will be forever unpayable. Compound interest will grow it to infinity, requiring ever larger debt servicing until the "debt monster" consumes its host and KILLS THE ECONOMY. |

essays / site map / view all movies / contact |